January 2015

What is an industrial accident?

The answer to this question is of paramount importance to both employers and injured workers in Utah. The amount of benefits available to an injured worker, and potentially owed by an employer, are directly impacted by whether an industrial injury is classified as an “industrial accident” under the Utah Workers’ Compensation Act, or an “occupational disease” under the Utah Occupational Disease Act.

Utah workers’ compensation law is somewhat unique in that it allows for apportionment in occupational disease claims. Apportionment allows a court to identify all causes of a medical condition, and then adjust the benefits awarded to reflect only the percentage of the injury actually caused by the employment. This system ensures fairness as the worker is paid for the industrial portion of her injury, no matter how slight, and the employer is released from liability for any non-industrial causes of the worker’s condition.

In contrast, apportionment is not available in industrial accident claims. A worker injured by “accident” is awarded full benefits for her entire condition upon proving her claim—even if the industrial accident only slightly contributes to, or aggravates a primarily non-industrial injury. The tradeoff is that, unlike in occupational disease claims, the employment is not assumed to be a legal cause of the worker’s condition. Instead that causal connection must be proven by the worker, the failure of which completely bars an award of benefits.1

Historically, Utah courts drew a common-sense dividing line between the two types of claims. An “industrial accident” was logically defined as a distinct, injury-producing event at work (e.g., falling off a ladder). An “occupational disease” was considered a medical condition that developed gradually as a result of a worker’s exposure to the regular duties of employment (e.g., extensive use of a ladder every day for months or years, resulting in a damaged knee).2

Unfortunately, Utah courts have since departed from that common-sense distinction. In the 1940s, Utah passed an exceptionally restrictive statute that essentially limited occupational disease claims to only a few, specifically identified types of conditions. The courts reacted by steadily expanding the definition of “industrial accident” to cover those gradually developing conditions which fell outside the narrow coverage of the new occupational disease statute, but which also failed to meet the original definition of “industrial accident” due to their gradual onset. Unfortunately, this initially well intentioned expansion has proceeded unchecked for nearly 75 years, and has now far exceeded the bounds of necessity. The courts’ current interpretation of the law essentially allows all gradually developing conditions (even those arising over a period of years) to be claimed as “industrial accidents.” This unbridled expansion has essentially caused a de facto repeal of the Occupational Disease Act and its apportionment provision.

The Utah Legislature has, somewhat recently, indicated its desire to reverse this unnecessary judicial expansion. In 1991, a new Occupational Disease Act was enacted, eliminating the restrictions of the original Act, and expressly providing compensation for “all” injuries and conditions gradually caused by the duties of employment. However, in the 23 years since its enactment, the Utah appellate courts have not been presented with the opportunity to interpret the “new” statute and define its impact upon the current expanded interpretation of what constitutes an industrial accident. As a result, the lower courts have maintained the status quo, continuing to apply the judicially expanded interpretation of the now superseded Occupational Disease Act. Through a currently-pending appeal before the Utah Court of Appeals, our firm has provided the Court with the opportunity to interpret the new statute. In doing so, we have requested that the Court give force to the Legislature’s intent that there be a clear and logical distinction between “industrial accidents” and “occupational diseases.” In issuing this challenge to the Court, we acknowledge the general hesitance of appellate courts to overturn longstanding precedent. However, we are hopeful that the Court will see the overwhelming need for clarification and reform in this hotly contested area of law. The specific details of the case will be shared in a second installment of this article once the Court of Appeals has rendered its decision.

Protecting Your Intellectual Property in a Distribution Contract

February 2015

In a case still unfolding in United States District Court for the District of Utah, there is a lesson to be learned for all who want to ensure protection of their intellectual property. In December 2013, the U.S. District Court for the District of Utah granted partial summary judgment in favor of the defendant 4EverYoung Limited d/b/a Dermapenworld («4EverYoung») regarding plaintiff’s defenses to specific performance. The court concluded that twelve affirmative defenses asserted by Derma Pen, LLC («Derma Pen») against 4EverYoung’s demand for specific performance were not sufficient to excuse its obligation under a sales distribution agreement to sell its trademark and domain name.

The court undertook an analysis of the terms of agreement in light of 4EverYoung’s motion for partial summary judgment. The district court determined there were two contingent rights pursuant to the agreement: first, Derma Pen was required to offer the trademark/domain name for sale to 4EverYoung upon termination of the contract pursuant to section 11 after establishing their value; and, second, 4EverYoung had the right of first refusal if Derma Pen received an offer for purchase of the intellectual property from any third-party. The court found that termination of the contract pursuant to section 11 triggered the contingent rights, but no third party ever offered to purchase the trademark or domain. The court determined that Derma Pen’s obligation to establish the valuation of the trademark and domain name and to offer them for sale was triggered but that «Derma Pen has never offered the Trademark and the Domain Name to 4EverYoung.»

Next, the court evaluated Derma Pen’s twelve affirmative defenses in response to 4EverYoung’s request for specific performance, finding that none excused Derma Pen’s obligation to offer its trademark and domain for sale. The court’s decision severely affected Derma Pen’s case and allowed 4EverYoung to request specific performance, requiring Derma Pen to establish a value and offer the trademark and domain name for purchase by 4EverYoung.

This case is a great example of why an intellectual property owner must fully understand of the rights and obligations contained in any contractual agreement before executing the contract, as well as the implications of terminating that contract. A contingent obligation to sell intellectual property may be acceptable during negotiations, but understanding your obligations under the contact is essential to protecting your rights.

NHTSA Grants Petition for Inconsequential Determination

January 2015

Richards Brandt clients China Manufacturers Alliance, LLC (“CMA”) and Double Coin Holdings Ltd Obtain Favorable Outcome on Petition for Inconsequential Determination Before the National Highway Safety Traffic Administration (“NHTSA”).

Double Coin is one of the world’s largest manufacturers of truck, industrial, and off-the-road tires. CMA is the North American subsidiary of Double Coin. In late May of 2014, NHTSA’s Office of Defects and Investigations notified CMA that two of the Double Coin model tires it was selling did not include

a load range symbol. The Federal Motor Vehicle Safety Standard (“FMVSS”) No. 119 establishes strength, performance, endurance standards for truck tires, as well as marking requirements. Among the ten marking requirements is inclusion of a load range symbol.

CMA and Double Coin submitted a noncompliance report. We then helped CMA and Double Coin prepare a petition for inconsequential determination seeking exemption from the remedy provisions of the Motor Vehicle Safety Act. CMA and Double Coin also commenced an internal review of all tires being sold. From this review, CMA and Double Coin determined that additional tire models were missing the load range symbol, and CMA and Double Coin took the necessary steps to ensure that going forward all Double Coin tires had the load range symbol.

CMA and Double Coin then submitted a revised noncompliance report and we worked with CMA and Double Coin on a revised petition for inconsequential determination to cover all tire models at issue. NHTSA published CMA and Double Coin’s Petition on September 14, 2014. See 79 Fed. Reg. 55068. In the Petition, we argued that the missing load range symbol was inconsequential to motor vehicle safety because Double Coin tires meet or exceed the strength, endurance and performance standards of FMVSS No. 119 and because the information conveyed by the load range symbol was included on all Double Coin tires by Double Coin’s optional inclusion of a load index symbol and ply rating on each tire. Additionally, all Double Coin tires, consistent with the marking requirements of FMVSS No. 119 contained appropriate maximum load/maximum pressure information. After considering CMA and Double Coin’s Petition, NHTSA agreed, granted the Petition, and exempted CMA and Double Coin from the remedy provisions of the Motor Vehicle Safety Act. See 79 Fed. Reg. 78562.

Contact me for more information or questions on this or other regulatory or product liability matters at 801.531.2000 or steven-bergman@rbmn.com.

Utah Workers’ Compensation: The Important Distinction Between Accident and Disease

January 2015

What is an industrial accident?

The answer to this question is of paramount importance to both employers and injured workers in Utah. The amount of benefits available to an injured worker, and potentially owed by an employer, are directly impacted by whether an industrial injury is classified as an “industrial accident” under the Utah Workers’ Compensation Act, or an “occupational disease” under the Utah Occupational Disease Act.

Utah workers’ compensation law is somewhat unique in that it allows for apportionment in occupational disease claims. Apportionment allows a court to identify all causes of a medical condition, and then adjust the benefits awarded to reflect only the percentage of the injury actually caused by the employment. This system ensures fairness as the worker is paid for the industrial portion of her injury, no matter how slight, and the employer is released from liability for any non-industrial causes of the worker’s condition.

In contrast, apportionment is not available in industrial accident claims. A worker injured by “accident” is awarded full benefits for her entire condition upon proving her claim—even if the industrial accident only slightly contributes to, or aggravates a primarily non-industrial injury. The tradeoff is that, unlike in occupational disease claims, the employment is not assumed to be a legal cause of the worker’s condition. Instead that causal connection must be proven by the worker, the failure of which completely bars an award of benefits.1

Historically, Utah courts drew a common-sense dividing line between the two types of claims. An “industrial accident” was logically defined as a distinct, injury-producing event at work (e.g., falling off a ladder). An “occupational disease” was considered a medical condition that developed gradually as a result of a worker’s exposure to the regular duties of employment (e.g., extensive use of a ladder every day for months or years, resulting in a damaged knee).2

Unfortunately, Utah courts have since departed from that common-sense distinction. In the 1940s, Utah passed an exceptionally restrictive statute that essentially limited occupational disease claims to only a few, specifically identified types of conditions. The courts reacted by steadily expanding the definition of “industrial accident” to cover those gradually developing conditions which fell outside the narrow coverage of the new occupational disease statute, but which also failed to meet the original definition of “industrial accident” due to their gradual onset. Unfortunately, this initially well intentioned expansion has proceeded unchecked for nearly 75 years, and has now far exceeded the bounds of necessity. The courts’ current interpretation of the law essentially allows all gradually developing conditions (even those arising over a period of years) to be claimed as “industrial accidents.” This unbridled expansion has essentially caused a de facto repeal of the Occupational Disease Act and its apportionment provision.

The Utah Legislature has, somewhat recently, indicated its desire to reverse this unnecessary judicial expansion. In 1991, a new Occupational Disease Act was enacted, eliminating the restrictions of the original Act, and expressly providing compensation for “all” injuries and conditions gradually caused by the duties of employment. However, in the 23 years since its enactment, the Utah appellate courts have not been presented with the opportunity to interpret the “new” statute and define its impact upon the current expanded interpretation of what constitutes an industrial accident. As a result, the lower courts have maintained the status quo, continuing to apply the judicially expanded interpretation of the now superseded Occupational Disease Act. Through a currently-pending appeal before the Utah Court of Appeals, our firm has provided the Court with the opportunity to interpret the new statute. In doing so, we have requested that the Court give force to the Legislature’s intent that there be a clear and logical distinction between “industrial accidents” and “occupational diseases.” In issuing this challenge to the Court, we acknowledge the general hesitance of appellate courts to overturn longstanding precedent. However, we are hopeful that the Court will see the overwhelming need for clarification and reform in this hotly contested area of law. The specific details of the case will be shared in a second installment of this article once the Court of Appeals has rendered its decision.

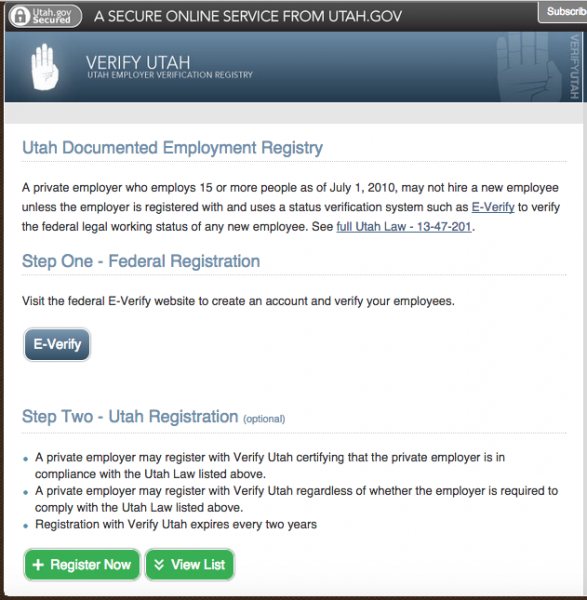

E-Verify Compliance Video Presentation

Kristina Ruedas

September 23, 2014

Common pitfalls to avoid when complying with E-Verify and other laws.

Who can use or access the E-Verify system at your place of business. Limit access to a few employees trained in the I-9 process and E-Verify system.

What is E-Verify according to the USCIS.

Enroll in E-Verify

Utah’s E-Verify Requirements

2014 Executive Orders on Immigration Video Presentation

President Obama decided to pursue Immigration Reform through Executive Orders. May hear something after November 5, 2014.

Form I-9 Compliance Video Presentation

September 23, 2014

Complying with the rules and regulations under the Form I-9 enforced by USCIS.

In September 2012, 520 criminal work place enforcements and arrests took place. In September 2013, more fines were issued, in one case the government issued a $34m to settle systematic visa fraud and abuse. ICE is enforcing felony criminal charges. The Grand America was fined $2m for immigration violations.

Fines and penalties are expected to increase along with re-audits by ICE.

Correct your measures

Audit your forms

Train your employees

Execute I-9 compliance plan

Same Sex Marriage – SCOTUS Watch is On

September 30, 2014

U.S. Supreme Court Justices began private meetings yesterday, September 29, 2014, and the Justices could decide whether to take up the issue of same sex marriage rulings from 4 federal appellate court decisions. Currently, 36 states have laws allowing or prohibiting same sex marriage. Same sex marriages are allowed in 19 states and the District of Columbia. Judges in 14 states have struck down prohibitions to same sex marriage.

State Laws – Wikipedia

Five states (UT, OK, VA, IN, WI) filed Petitions for a Writ of Certiorari requesting the Supreme Court to review federal circuit decisions affirming district court decisions finding same sex marriage prohibitions unconstitutional. In addition to the states, 30 corporations, including Alcoa, Amazon, eBay, General Electric, Intel, NIKE, Pfizer, and Target, have filed requests that the Supreme Court should address same sex marriage laws and recognize same sex marriages nationwide.

Some of the recent decisions that SCOTUS could review, include:

Recently, a Louisiana district court judge bucked the current trend of finding same sex legislation unconstitutional. This decision is Robicheaux v. Caldwell, No. 13-5090, 2014 U.S. Dist. LEXIS 122528 (D. La. 2014) (granting defendants’ motion for summary judgment and holding that Louisiana, under a rational basis standard of review, has a legitimate interest in defining the meaning of marriage through democratic process). This decision echoes the sentiment of the dissenting opinion in the Kitchens v. Herbert decision.

The watch is now on; we shall see how SCOTUS decides to address or duck the issue.

Avoiding Common Pitfalls of Estate Planning

September 2014

Estate planning is a process—not an event—often wrought with common and routine mistakes, the most common of which include the following:

A properly drafted estate plan can help avoid these mistakes.

THE PROBLEM WITH DOING NOTHING

When a person dies without a will, the person is said to have died intestate. The laws of the state where the person lived at the time of death will apply, and those laws determine the liquidation and distribution of the estate. Many people do not have a favorable opinion of, or trust, politicians. Yet, when you do nothing, you are letting your state legislature draft your estate plan. Under intestacy laws your property could ultimately end up in the hands of unwanted beneficiaries or administrators. Would you want an ex-spouse to be responsible for receiving or administering your property? Creating a trust can solve this problem.

FAILURE TO COORDINATE INSURANCE/RETIREMENT ASSETS WITH AN ESTATE PLAN

A common misconception is that a will controls the distribution of assets upon death. However, a will only governs probate assets (i.e., assets not controlled by trusts, joint tenancy, and/or beneficiary designations.) Today, many assets get transferred without consideration of a will. For example, joint tenancy assets pass to the surviving joint tenant and life insurance, annuities, and IRAs/401(k)s are controlled by beneficiary designations. These assets, upon death of the owner, pass to the named beneficiary regardless of the provisions outlined in a will. So, if an individual designates only one child as a beneficiary in a life insurance policy, but prepares a will naming all children as equal beneficiaries, the beneficiary designation in the insurance policy trumps the directions in the will, potentially creating problems the deceased never intended, and which could have been avoided by coordinating insurance/retirement assets with an estate plan.

ADDING INDIVIDUALS TO BANK ACCOUNTS

Adding a person to a bank account subjects the account to that person’s creditors. For example, when a parent adds a child to his/her checking account in order to allow the child to manage the bills and expenses, the child becomes a co-owner of the account, and that account becomes subject to the child’s creditors. Creating a revocable trust can protect assets while still allowing another person to pay your bills.

TRANSFERRING THE FAMILY HOME IN JOINT TENANCY WITH AN ADULT CHILD

A parent conveying title of their home to an adult child as joint tenants to avoid probate court is a routine mistake for several reasons. (1) This transfer constitutes a taxable gift under IRS regulations. (2) The home becomes subject to the child’s creditors who can then potentially force the sale of the home. (3) The sale of the home results in potential capital gains tax to the child. A revocable trust can accomplish transfer of real property without the ensuing problems.

FAILURE TO PLAN FOR A DISABLED CHILD

If you have a disabled or special needs child, you should consider leaving the child’s inheritance in a specially drafted trust to protect the child while keeping the child eligible for public assistance. An inheritance could cause forfeiture of public assistance benefits to a special needs child. Through a supplemental needs trust a child’s inheritance can be managed by a selected family member without sacrificing Medicaid or SSI benefits.

CONCLUSION

Proper planning creates peace of mind, streamlines administration, and preserves your property for your family and future generations. With attention and regular checkups we are able to catch the mistakes described above (and more) and make the necessary changes to avoid unnecessary problems and costs.

Utah’s Petition for Writ of Certiorari in Kitchens v. Herbert – Same Sex Marriage

September 2014

In legal circles as in life, be careful what you wish for. The news is out that Utah has filed a Petition for a Writ of Certiorari in the same sex marriage case. Utah is requesting the United States Supreme Court to review the 10th Circuit’s ruling upholding the Utah district court’s decision that the Amendment 3 unconstitutional.

As you may know, Utah’s Amendment 3, Article I, Section 29 on [Marriage.] reads (1) Marriage consists only of the legal union between a man and a woman. (2) No other domestic union, however denominated, may be recognized as a marriage 070-416 or given the same or substantially equivalent legal effect.

In a surprising move to some, the plaintiffs in Utah’s same sex marriage case indicated that they intend to join in Utah’s request to have the 10th Circuit’s ruling reviewed. The Salt Lake Tribune reporter accurately noted: «victors rarely ask for a rematch.» The pundits have started weighing in on the chances of the United States Supreme Court accepting the case for discretionary review.

In a nutshell, the plaintiffs’ decision to join rather than oppose Utah’s petition should give the State and those who oppose same-sex marriage pause for thought. The reason that the plaintiffs have decided to join in the State’s request is that Amendment 3 and the arguments that Utah is advancing in its support represent the best case – in the plaintiffs’ view – to have the United States Supreme Court uphold the unconstitutionality of same sex marriage laws. As the articles discuss, other states and other federal circuits have similar challenges in the pipeline. For proponents of same sex marriage, Amendment 3 is one of the, if not the, least defensible laws percolating up through the federal circuits. The plaintiffs want to argue Amendment 3 is unconstitutional rather than some other state’s statute because it is an easier argument to make.

Appellate court decisions are an effective means to achieve favorable laws in many areas of the law and in industry and commerce. Savvy parties and legal advocates, however, carefully choose which cases to appeal and which to accept in defeat. Perhaps Utah will be successful, and as the pundits note, it is likely that Utah’s petition will be joined with another state or states similar to petition, meaning that the United States will be considering other same 070-460 sex marriage bans in conjunction with Amendment 3. Nonetheless, the plaintiffs’ decision to join Utah’s petition is a telling sign as to how Amendment 3 compares to other states’ laws.

Additional Articles:

http://www.sltrib.com/sltrib/news/58165963-78/court-marriage-state-utah.html.csp

http://www.sltrib.com/sltrib/politics/58263347-90/utah-marriage-state-court.html.csp

http://www.scotusblog.com/2014/08/same-sex-couples-to-support-court-review-on-marriage/.

Good News for Small Nonprofits…Easy 501(c)(3) Filing Under 1023EZ

July 2014

IRS Announces Simplified Application for Small Charities Applying for 501(c)(3)

Starting July 1, 2014, small charities may be eligible to apply for tax exempt status by filing the

Internal Revenue Service’s new Form 1023-EZ.

Until recently, all non-profit organizations seeking tax-exempt status under 501(c)(3) were required to: pay the $850 filing fee; complete the 26 page IRS Form 1023; and provide the IRS with a detail summary of charitable activities, governing documents and financials.

Now the Internal Revenue Service has simplified the application for small charities. Most organizations that have assets valued less than $250,000 and annual gross receipts of $50,000 or less will qualify to use the new Form 1023-EZ. That form is only 3 pages and the application fee is $400. The new Form 1023-EZ must be filed online.

If you are planning formation a non-profit charity, you may want to consider filing the new Form 1023-EZ. The eligibility requirement are contained in the new Form1023-EZ’s instructions.

INSTRUCTIONS

http://www.irs.gov/pub/irs-pdf/i1023ez.pdf

NEW APPLICATION FORM

http://www.irs.gov/pub/irs-pdf/f1023ez.pdf

This is good news for tax planning for family foundations, athletic clubs, and charitable groups. Call Greg Steed, Chair of the Trusts and Estates Practice Group at RBMN, at 801.531.2000 if you have any questions.